Taxpayers may voice their concerns in rate adoption by attending the adoption hearings of the entities of interest. If property values increase and the rate stays the same as the previous year, the result will be a tax increase. Increases in value can sometimes mean decreases in rates. It is important for the taxpayer to understand that if values increase then there are more dollars for the entities to spread throughout their budgets. When breaking down the HASKELL County jail population by gender, females are a minority compared to male prisoners and make 6 with 4 female and 41 male inmates. HASKELL County has 62 jails with an average daily population of 208 inmates with a total of 62 jail population. Once an appraisal roll is certified, the taxing entities go through a process to adopt a tax rate. Haskell County, TX Jail and Prison System.

Using both factors, a property's value divided by $100, then multiplied by the adopted tax rate, equals that property's taxes.

The appraised value is only one factor of property taxes. Combining technical excellence and trust it just makes sense. The result is unmatched customer experience. The Haskell CAD also collects property taxes for the Taxing Entities within its jurisdiction. Haskell combines architecture, engineering and construction (AEC) expertise with a corporate culture of transparency and integrity. This abolished the lack of uniformity of assessment ratios used by separate appraising entities of the past. This bill created one appraisal district within each county to appraise properties for all taxing entities at 100% of market value with fairness and equity.

#Haskell texas code

The Property Tax Code was created in 1979 by legislation known as the Peveto bill. Before the creation of appraisal districts all taxing entities had their own appraisal staff.

#Haskell texas verification

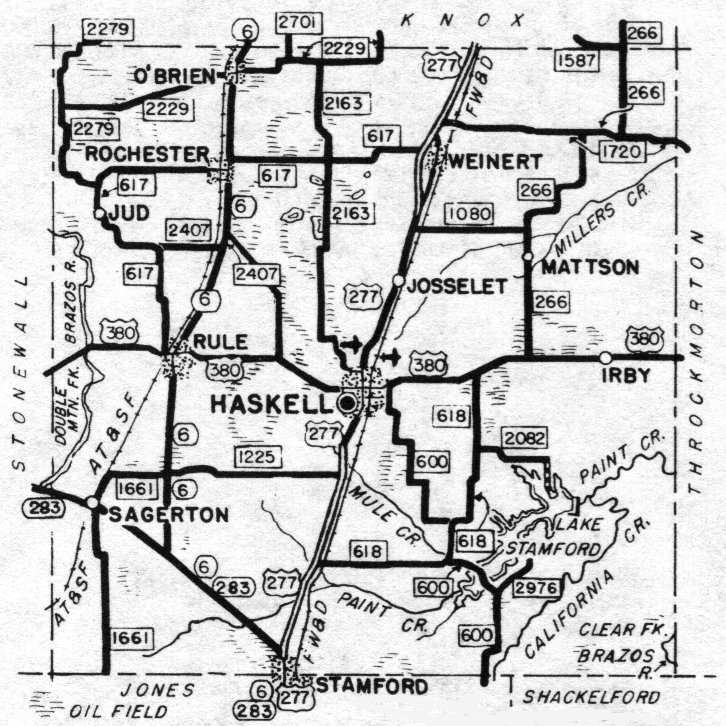

For legal ownership verification contact Haskell County Appraisal District.Ĭontact: Appraisal District (CAD Contact Page) or Pritchard Abbott (P&A Contact Page)Īppraisal districts in Texas were created by and are governed by the Texas Property Tax Code. Users of the information displayed in this map service are strongly cautioned to verify all information before making any decisions. Although information from Land Surveys may have been used in the creation of this product, in no way does this product represent or constitute a Land Survey. cannot accept any responsibility for any errors, omissions, or positional accuracy, and therefore, there are no warranties which accompany this product. Although we strive to provide the best data we can, we sometimes use data developed by sources outside Pritchard & Abbott Inc. The information used in these applications were derived from digital databases in Pritchard & Abbott Inc. Users of this information should review or consult the primary data and information sources to ascertain the usability of the information. This product is for informational purposes and may not have been prepared for, or be suitable for legal, engineering, or surveying purposes.

0 kommentar(er)

0 kommentar(er)